The Oregon Legislative Revenue Office calculated how federal tax policy changes will affect Oregon tax collections. (Slide from Office of Economic Analysis presentation)

The federal “Big, Beautiful Bill” is setting up a painful choice for the Oregon Legislature: Cut services or increase revenue. School district leaders won’t see a change to their funding anytime soon, but they are being warned it could get ugly in the future.

Federal HR 1, which President Donald Trump dubbed the “Big, Beautiful Bill,” hit Oregon with a double whammy, reducing federal funding and Oregon’s own tax revenues.

The September Oregon Economic and Revenue Forecast released Aug. 27 announced HR 1’s pain would be worse than the Legislature planned for.

“It’s not the sky is falling, but it’s certainly a wake-up call to start looking for umbrellas,” said Stacy Michaelson, OSBA Government Relations and Communications director.

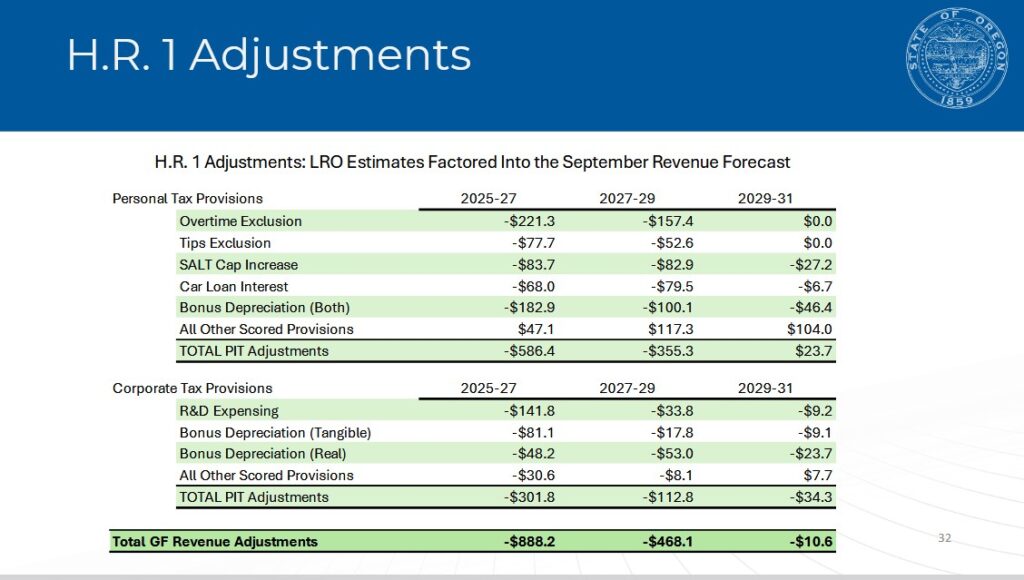

Oregon is one of five states with its tax code tied automatically to the federal tax code. When a taxpayer’s federal taxable income drops due to new or increased deductions at the federal level, their taxable income also drops for Oregon tax purposes. The tax cuts in the federal bill instantly dropped Oregon’s expected revenues $888 million, according to the Legislative Revenue Office.

The Oregon Legislature, anticipating federally driven funding reductions, passed a 2025-27 budget with a $473 million ending balance cushion. With HR 1 kicking out a big hole in addition to some other small adjustments, the first revenue forecast of the new biennium projected Oregon’s General Fund will be $373 million in the red.

At this point, it’s unclear exactly how, or when, the state will respond. Oregon revenue growth is slowing but not stagnating, despite some worrying signals, according to Oregon Chief Economist Carl Riccadonna. With nearly two years to go until closing the books on this biennium, slightly better-than-forecast growth could close that gap.

Oregon economists have consistently underestimated the state’s economic growth in recent biennia, leading to huge kicker tax refunds that were triggered by the state collecting revenue more than 2% higher than the biennial budget.

Riccadonna led a revision last year of the state’s forecast models to try to eliminate those big underestimates. The new model bumped up Oregon’s revenue projections almost $1 billion last year, giving the Legislature more money to budget for 2025-27. If the new model overestimated revenue growth, the funding gap could grow wider as real data come in.

Even if projections continue to trend downward for this biennium, cuts to the State School Fund mid-biennium are rare, although it happened in 2010 as Oregon struggled with the Great Recession fallout.

The report last week held the chances of an Oregon recession at 27%, higher than is typical. Unlike 2010, this time Oregon has more than $3.4 billion projected in reserves banked in the Education Stability Fund and the Rainy Day Fund and plenty of time to course correct.

Still, with less local money coming in, inflation continuing and federal funding shrinking, Oregon will have to cut services or increase taxes in the next biennium.

HR 1 will cut federal funds to Oregon by about $1 billion in 2025-27, mostly to the Department of Human Services and the Oregon Health Authority, according to the Oregon Department of Administrative Services. The Oregon Department of Education isn’t facing direct cuts, but cuts to Medicaid and SNAP have downstream implications for school nutrition and school health services.

Michaelson warned that although this biennium could get tight, districts really need to be thinking about a potentially more austere future. HR 1’s cuts to federal funding in Oregon are projected to jump up to $5.7 billion in 2027-29 and $8.4 billion in 2029-31.

OHA is targeted for the bulk of those federal cuts. Currently the biggest line item in Oregon’s total funds budget, OHA receives over half of its funding via federal dollars. With the cuts in HR 1, Oregon will have to fill in OHA’s budget with state money if it doesn’t want to deny people health care. It would take over 10% of the state’s General Fund to fill that budget hole. Unlike most other elements of the state budget, the State School Fund is primarily reliant upon the General Fund, making it especially sensitive to shifts in available resources.

“Unless something changes, it’s going to be bad,” Michaelson said, “but a lot could still change.”

For starters, the Legislature will receive a new forecast every three months that could radically alter the picture. The next one is scheduled for Nov. 19.

In the lead-up to the short 2026 legislative session, which begins Feb. 2, funding concerns will almost certainly be on legislators’ minds. Another special session before the short session also isn’t out of the question. Options legislators are likely to be weighing include accessing reserves, disconnecting from the federal tax code, and making budget cuts where possible without impacting direct services.

During the Legislature’s revenue report hearing, though, Rep. Pam Marsh, D-Jackson County and a member of the Interim House Revenue Committee, said there is “nothing on the table at this moment” for legislative action.

Gov. Tina Kotek has not made a public statement on next steps.

Elections in 2026 and 2028 could also lead to changes in federal tax law and funding policies.

“HR 1 dominates all of this,” said Oregon Senior Economist Michael Kennedy during the hearing.

– Jake Arnold, OSBA

[email protected]