Low 2022 investment returns have tilted the Oregon public pension system toward a small 2025 rate increase, according to documents available Monday. If 2023 returns don’t pick up the pace, though, the increase could be bigger.

With the 2025-27 projected rate increase, schools would pay more than $2 billion to meet Public Employee Retirement System obligations, a $490 million increase from this biennium. Much of the increase stems from a projected 15% growth in schools’ payrolls.

The PERS Board meets Friday, Sept. 29. The agenda includes a review of the system’s value through the end of 2022 and the effect on 2025-27 rates. Final rates won’t be set until next summer.

Milliman, the state’s actuary, based its advisory rate for 2025 on actual returns from 2022 and an assumption that 2023 would meet formula expectations.

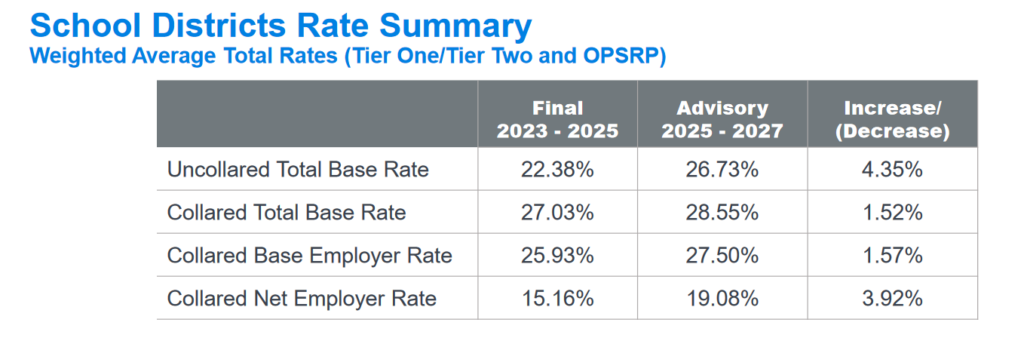

For school districts, the average base rate is projected to increase 1.57 percentage points to 27.5%. The net rate, which includes the value of side accounts that have fallen in value, would increase 3.92 percentage points to 19.08%.

Milliman estimates state employers can expect a 27.32% base rate, a 1.68 percentage point increase.

These rates are systemwide averages. Specific school district advisory rates will be available in December.

PERS’ formula assumes a 6.9% annual rate of return to keep the system level. In 2022, it lost 1.55%. So far in 2023, it’s showing a 3.79% return. If the low returns continue, PERS will need even more money from employers to balance its obligations to employees.

PERS rates shot up significantly between 2009 and 2021. OSBA has championed efforts to soften PERS’ bite into education funds. Rates dropped slightly in 2021 and stayed flat in 2023.

– Jake Arnold, OSBA

[email protected]